Expect your average homeowners insurance cost in Indiana to change depending on some factors. Your personalized policy rate will be determined by factors such as the crime rate in your locality, the size and ages of your home, how much coverage you choose, and your credit rating.

What are the best insurers to choose from?

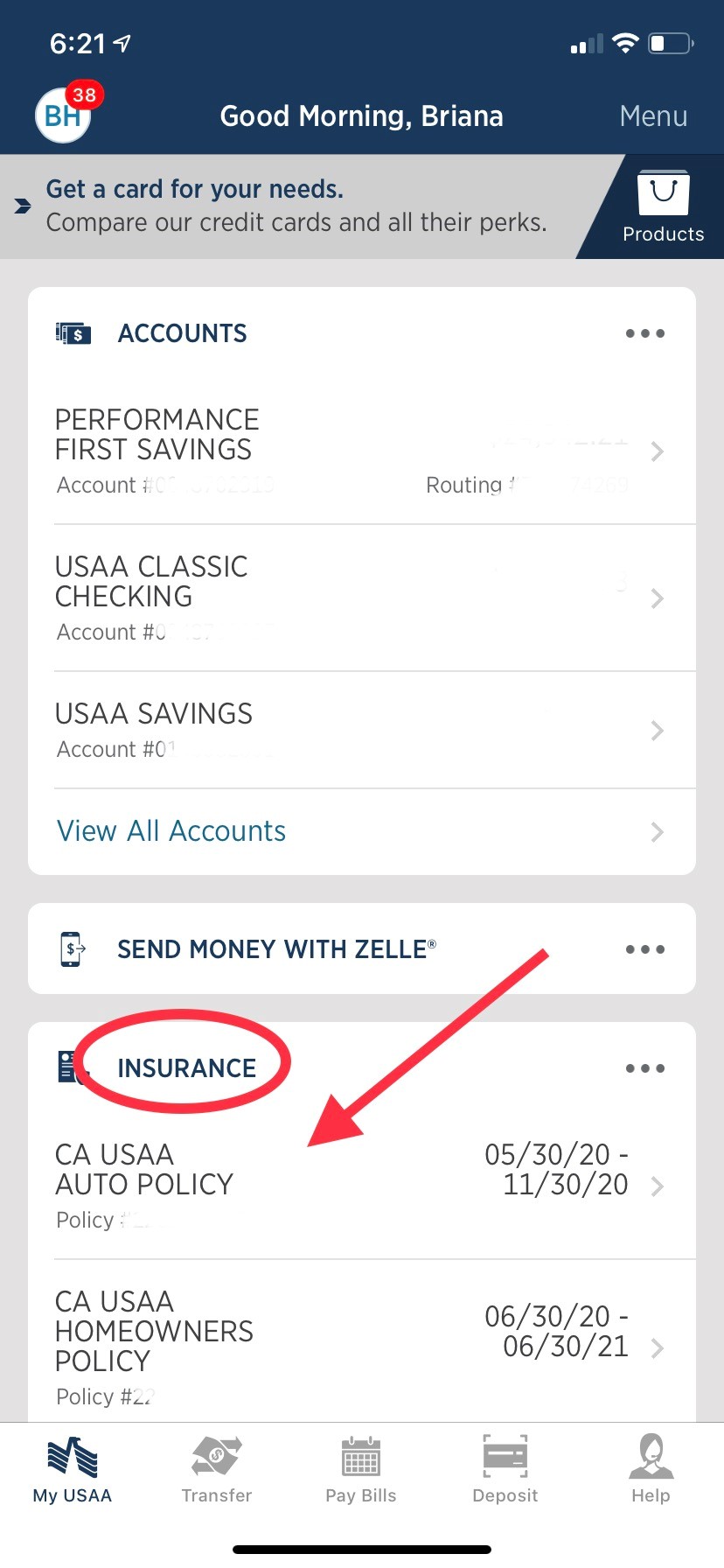

Comparing quotes is the key to getting the best deal for homeowners insurance. Research is necessary to determine the company that offers you the most benefits.

Allstate offers the cheapest homeowners insurance Indiana, with an average monthly rate of $107 for a policy covering up to $250,000. Bundling home and auto insurance with Erie can save you even more money.

You want to protect your home, which is a major investment. The best homeowners insurance indiana ensures that you are not responsible for any unexpected losses, such as fires or theft.

Good insurers will offer multiple options to help you when you need them, such as a 24/7 emergency number, a claims representative who is dedicated to your case, and online tools to manage your insurance policy. They can guide you through filing a claim, and they will answer any questions or concerns that you may have.

You can also shop around for an insurer that is ranked high in customer satisfaction by J.D. Power is an independent consumer review group that measures satisfaction with customers across the nation. Customers who rate the best companies are usually those with low rates and strong customer service.

The homeowners insurance indiana cost is influenced by your deductible. The deductibles are different for each company. Be sure to compare them to find the lowest deductible.

Coverage for replacement of personal property. It pays to replace items damaged by theft or damage. These can include clothing, furniture, and electronic equipment.

Loss of Use: This coverage may help pay for a temporary residence while the home is being repaired if you are unable to occupy your home.

This insurance covers damage caused to other structures, such as fences, sheds and garages.

Liability coverage: Protects you in the case of an injury on your property. It can also help cover the cost of legal fees and court costs.

Termites, wood rot, and damaged roofs are common problems for older homes. There are some homeowners insurance indiana firms that charge a higher rate for older properties.

Indiana homeowners insurance is priced at $1,180 annually for $250,000 worth of coverage. The average cost of homeowners insurance in Indiana is $1,180 per year for $250,000 of dwelling coverage. This is 16 percent lower than the national rate and less expensive than states such as Kentucky and Illinois.

Indiana is a state that has a lot of challenges for homeowners throughout the entire year. This can lead to increased risk for home damage. If you're in a city that's more susceptible to tornadoes, hail storms or snow, it may be a good idea to consider purchasing flood insurance.