Knowing when to file a homeowner's claim is important if your house has been damaged. This will ensure your property is covered and you will avoid having to pay out of pocket.

When to file a homeowner's claim

There are many situations when it's a smart idea to file an insurance claim. It can be a long and tedious process, but if you're looking to have your claim resolved quickly, it's well worth it.

Read your insurance policy and make sure that you understand all of its terms. You will know how much you will have to pay and whether or not it is in your best interests to file a claim.

Your insurance agent can be contacted to discuss your policy and to ask for any documents that might be relevant. You can ask them for advice on the next steps.

It's important that you prepare yourself for the claim process. You should file your claim as soon as possible and keep a record of any conversations or documentation.

Keep a claim log

When you file an insurance claim, keep all the relevant details in mind. If you need to submit a claim in future, you will benefit from keeping track of all the details. You can speed up the process by keeping a log of all the conversations that you have throughout the claim process.

Keep copies of all documents you have. Your insurance company's adjuster will be able to assess the damage more accurately and thoroughly if you keep copies of any documentation.

Choosing to Make a Homeowners Claim

A common misconception is that filing for home insurance claims is a huge waste of your time. In reality, it's a very smart decision that could save you tens or hundreds of thousands of dollars in out-of-pocket expenses.

Often, a home insurance claim can be the only way to make sure your home is protected against major losses. It's worth filing an insurance claim in some cases to avoid an unexpected and expensive repair or replacement.

The right time to make a claim is when it makes the most sense for your family and your budget. It's never a good idea to file a home insurance claim if it won't help your family or your budget.

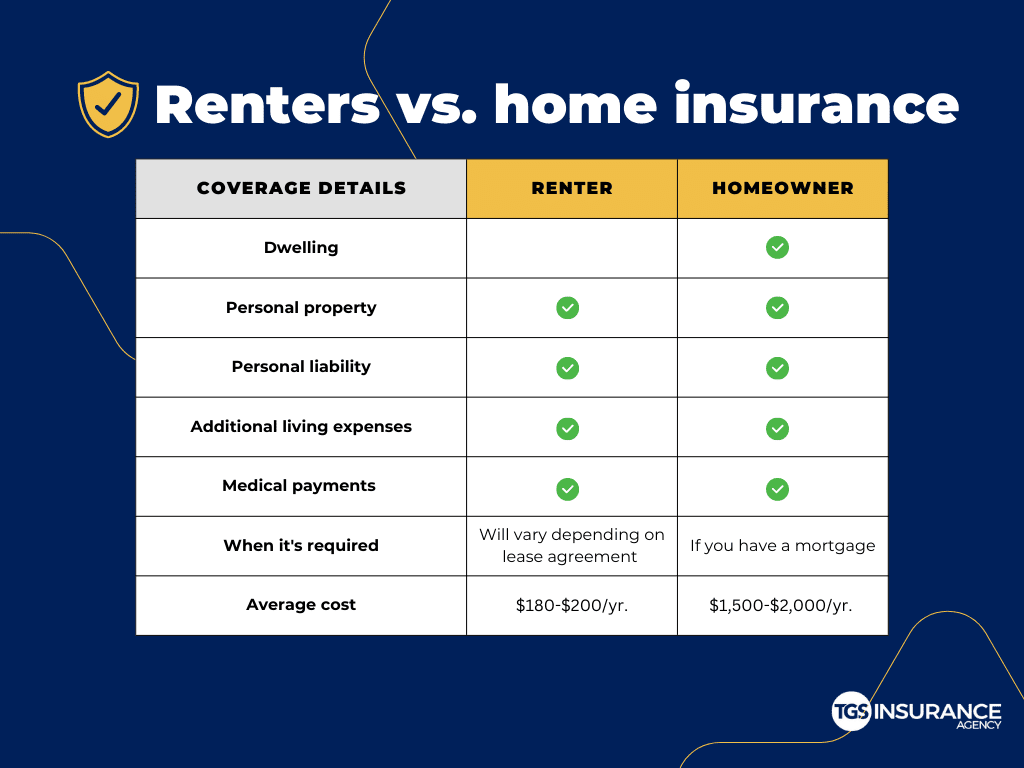

You should have liability coverage in your policy to cover any medical expenses incurred if someone gets injured on the property. It's best to talk with your insurance agent about the liability limit.

You'll also need to pay your deductible before your policy kicks in. Your deductible could be a certain dollar amount (or a percentage) of the total amount of your policy.