Proper health insurance is vital for travelers. It not only provides financial security while traveling, but also allows you to cancel your policy anytime before it becomes effective. You can also request a refund for any premium paid that was not used while you are abroad. It can be very difficult to get treatment in an emergency in the US because of the high cost of health care. Without insurance, you will have to pay for your expenses on your own, which can be risky.

Benefits

A great way to lower the cost of medical care while traveling abroad is through travel insurance. Medicare will not pay for medical expenses outside the United States. This could cause your family to lose their savings. Many travel insurance policies include coverage for emergency medical expenses. To ensure you are covered, it is important that you contact your insurance provider before you travel.

Even for short-term travel, it is vital to have health insurance for travel. Your travel insurance can cover you for medical emergencies or routine checkups. You'd have to pay out of pocket, and then submit a claim to the insurance company. This is especially useful if you are abroad and don't have access to local healthcare.

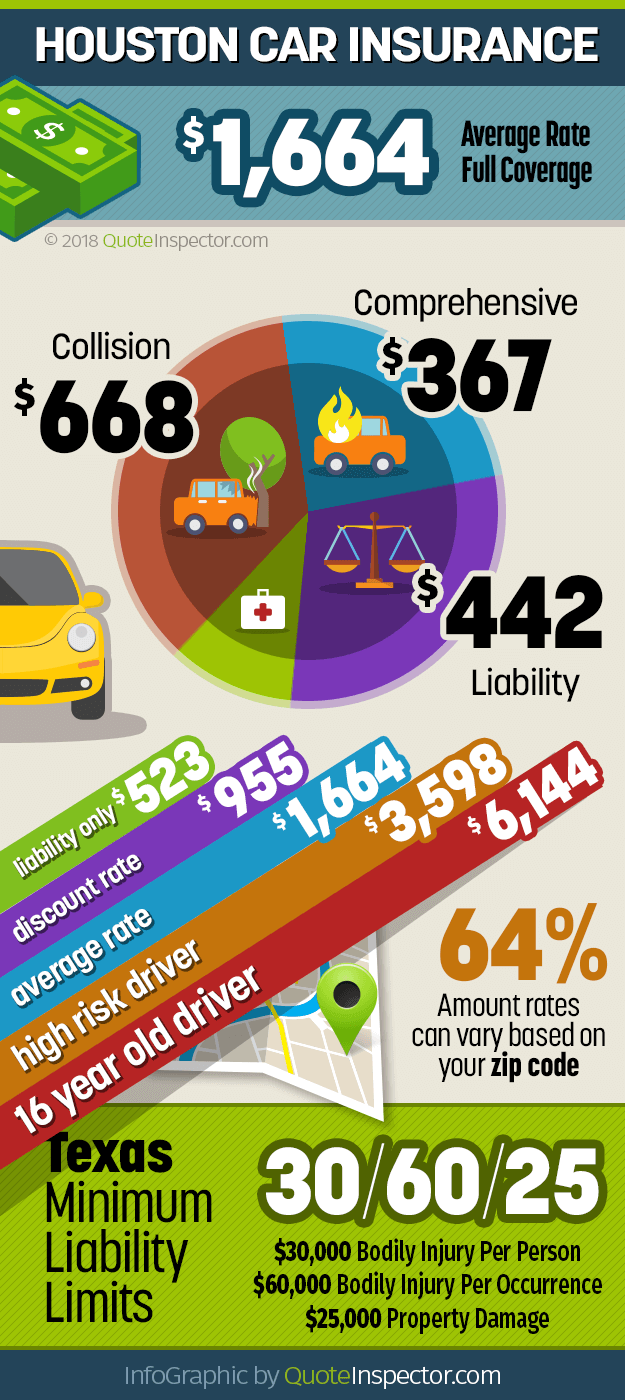

Costs

People who travel often need to purchase travel medical insurance. The best time to purchase the policy is at least six months in advance. A basic, low-benefit frequent flyer health plan might cost $100 per year for one person. However, a more comprehensive plan could cost twice as much for the same year. Frequent travelers policies are best for short trips. However, it is possible to pay significantly more for longer-term assignments or overseas trips.

Types

Travel insurance should be purchased for those who travel internationally. This policy will provide medical coverage in a foreign country and often covers emergency evacuation. The policy comes with limits and deductibles. For this reason, it is advisable to check the specific requirements of your domestic insurance plan before purchasing travel health insurance. There are many options for travel health insurance. You have the option to choose the plan that is most suitable for your needs and financial situation.

Pre-existing conditions covered

You have many options for finding comprehensive travel insurance that covers pre-existing conditions. While the exact terms of a pre-existing disease waiver depend on the insurer's policy, most policies will cover common chronic conditions. This covers heart disease, depression, diabetes and heart disease. It is also worth checking to see if your insurance policy covers drug addictions. Although pregnancy is not considered to be a pre-existing condition in most cases, some plans only cover it if there are normal births.

Pre-existing conditions refer to a current medical or dental condition. It must have existed before you purchased your policy. You may be subject to a condition that has developed after purchasing the policy. It is important to review the terms and conditions.