Kansas homeowners insurance prices are affected by several factors. It is important that you understand all the options for home insurance to ensure that you receive the coverage you need at a fair price. Kansas has many factors that could affect your homeowners insurance costs. Credit reports, severe weather, and where you live can all have an impact on the cost.

You can save money by looking for insurance companies that offer discounts or special features to help you save on your home insurance. Home insurance policies cover your personal property and liability. You may be covered for damage from hail, wind, or other natural disasters. If you wish to lower your rate, you can choose to pay a higher maximum deductible.

Allstate offers a wide range of home insurance policies. The standard HO-3 policy covers all perils unless otherwise specified in your policy. Another option is an HO-8 policy, which provides coverage for 10 different perils. You can also choose to add windstorm coverage. Windstorms can be dangerous in the tornado area. You might need windstorm coverage if you live where you are at highest risk.

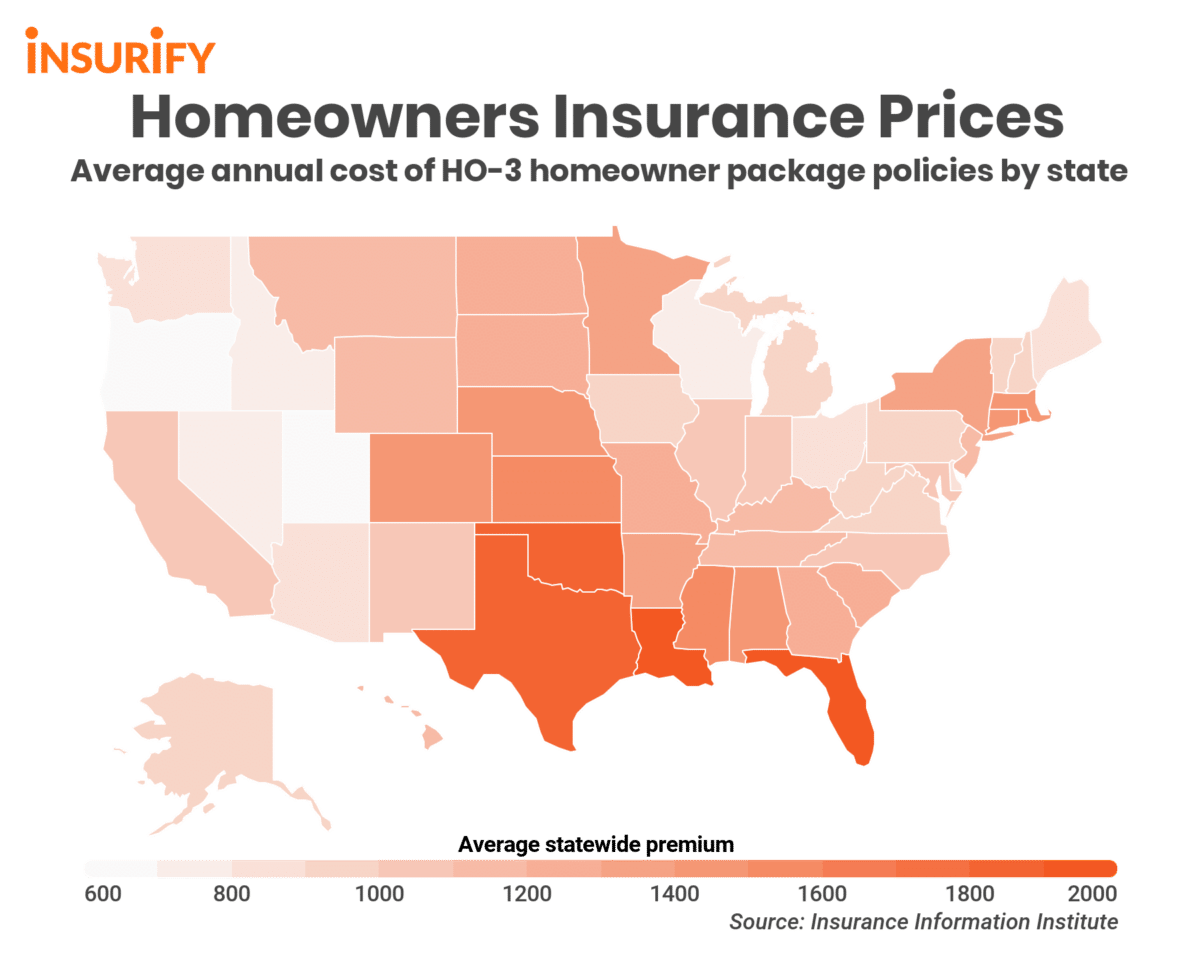

Kansas averages $2461 per annum for home insurance. This rate is second only to Oklahoma. However, the rates can be very low or very high depending on the town you live in. Gardner, Kansas, has one of the lowest home-insurance rates.

Insurify lets you compare quotes from multiple carriers. They have helped thousands of customers get the coverage they need at an affordable rate. SelectQuote can also help you to compare quotes. You can quickly obtain a quote online for Kansas home insurance.

Marysville Mutual is a great choice if you are looking for homeowners insurance in Kansas. Although they are not the largest company, they have a strong reputation and local expertise. This allows them to offer excellent customer service. Despite the fact that they do not have a large number of agents, they have a relatively low complaint index from the NAIC.

Prepare for extreme weather, especially in winter and autumn. Kansas homeowners should be aware of the possibility of hail and storms. Storm shutters are a good way to minimize the effects of severe weather. Installing storm-proof roofing can help protect your home from being damaged in storms.

If you live in a city, it is important to check with your local agent to see whether your city is in the FEMA National Flood Insurance Program. While the standard homeowners insurance policy will not cover flooding, you can purchase additional flood insurance. Consider adding earthquake and sewage backup coverage to your policy.

The quality of your homeowners insurance policy can vary greatly by selecting the right insurance company. It is best to shop around at least once a year to find the best rate.