Located in the state of Wisconsin, Milwaukee is a major city that attracts tourists from all over the world. The city is also the birthplace Harley Davidson motorcycles, and it hosts many festivals. The city's vibrant economy and extensive infrastructure make it a popular place to live.

Auto Insurance Milwaukee

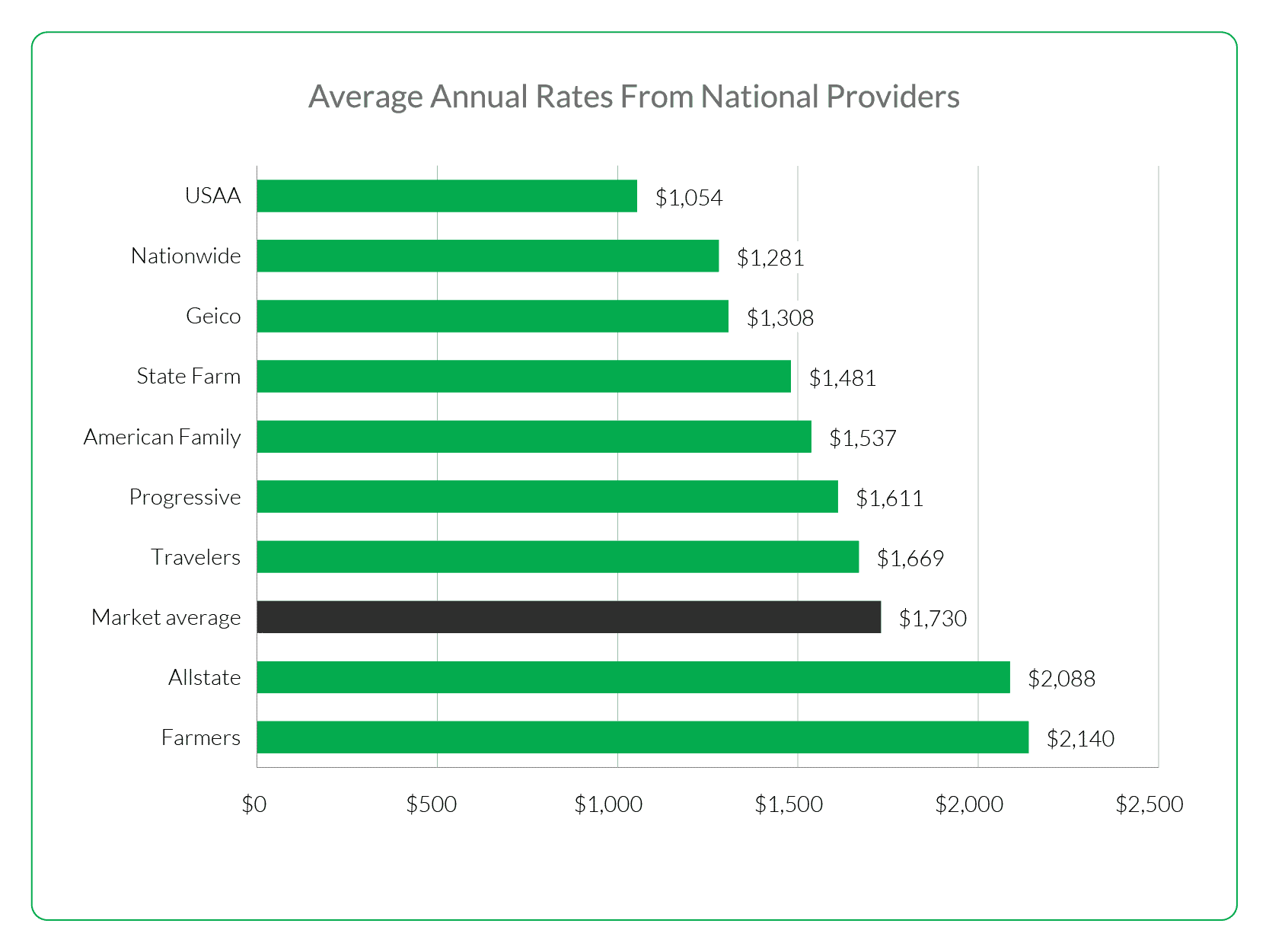

Milwaukee's car insurance laws are mandatory and can protect against costly damages. Car insurance rates in Milwaukee can vary depending on a number of factors. It is important to compare personalized car insurance quotes from various companies. This will help you understand the costs.

Minimum Car Insurance in Milwaukee

The 25/50/10 insurance plan in Milwaukee offers the lowest rates and meets all the state minimum liability requirements. In the event of an accident, it covers both property damage and bodily injuries. In addition, it includes coverage for uninsured and underinsured drivers.

More Comprehensive Coverage in Milwaukee

Consider raising your liability limit to cover the more expensive repairs if you're worried about the cost of insurance in Milwaukee. This will save you money over the long term and keep you from having to pay a higher monthly insurance premium.

Cheapest cars to insure at Milwaukee

The most affordable vehicles to insure tend to be compact SUVs and midsize pickup trucks. The reason is that these vehicles are rated less expensively on average than sports cars, large luxurious sedans, or performance exotics.

Auto insurance rates in Milwaukee based on credit score

Your credit rating is an important factor when determining car insurance rates. Your credit score is important because it can save you money over the long term.

It's a good idea, too, to review your credit report periodically and improve it as necessary. You can save money by having a high credit score on your monthly bills or even your Milwaukee car insurance.

It is true that drivers who increase their credit score up to the "Fair " tier, from the "Very-Poor" tier, see a 61% drop in the annual cost of auto insurance.

The same goes for young adults who are in good academic standing and maintain a spotless driving record. They can qualify for discounts on policies.

Shopping around, getting several quotes and taking full advantage of discounts are the best ways to reduce your auto insurance costs in Milwaukee. You'll get the best coverage for your needs by shopping around.

Get Car Insurance for Teenagers and Young Adults in Milwaukee

Age is another important factor in determining the cost of car insurance in Milwaukee. In Milwaukee, drivers younger than 25 are charged more than older drivers because they have a greater risk of being involved in an accident.

Milwaukee has many auto insurance companies, but finding the right one is important. Comparing car insurance quotes is the best way to achieve this. Visit the office of an agent for a quotation and to ask about any discounts.